ELSS- Smart way to save taxes

As part of your financial plans tax savings is a vital cog in the wheel. As per section 80 C of the Indian Income tax act you can claim deductions to the margin of 1.5 lakhs as this would cut down on your tax liability. In case if you are looking to save on taxes you should make more investments geared to section 80 C. Invest in ELSS onlines models itself as per section 80 C. Among all the tax saving investments ELSS seems to be the most popular and an efficient tax saving investment.

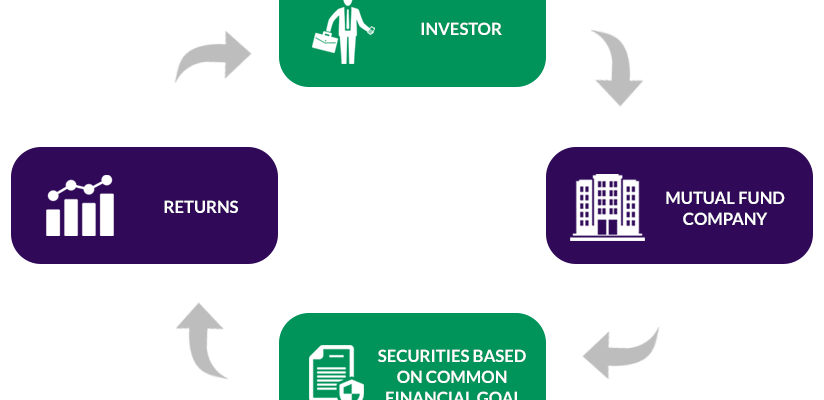

How an ELSS is going to work

As the name suggests ELSS is a diversified fund, where a majority of shares are invested in equity based funds of a company. The fund manager is going to prepare a diversified portfolio by investing in various types of assets spread across varied industries. The NAV would fluctuate on the basis of the underlying stocks and the varied benchmarks.

The logic of ELSS is that funds are bound to get effected by overall fluctuations of the equity market. But you need to keep the returns in line with your expectations and in the industry segment it is not affected by price movements. In case if the funds try to generate more returns it can pave way for capital appreciation in the long run.

Redemption and lock in period

Pretty much just like the other funds ELSS has a lock in period of 3 years. This is comparatively less when you compare it to the other investment types. What it would mean is that if you initiate a SIP in your ELSS fund then it would not be available for redemption till 3 years from the tentative date of investment. You may continue or exit the ELSS funds once 3 years are over. But if you are considering a long term investment perspective in mind, it is better to keep in mind a long term investment goal in mind.

When it would be the growth option once you are going to redeem the investment after 3 years. This means that you are going to avail the investment along with capital appreciation. When it is the dividend option, you are going to receive a regular dividend income from the company during the growth in period. Till the point they generate a profit there is no form of sure shot dividend. There are not permitted to declare dividends out of capital.

Potential of risk

ELSS goes on to invest in securities, and apart from other asset class there are suitable for investors who are empowered to work on a higher risk taking capacity. When it comes to the mid – sized caps. ELSS is rated to be safe as the volatile nature works out to be on the lower side. Since these funds go on to carry a higher degree of risk the income generating potential is on the higher side than the debt funds.

They also go a long way to help you achieve your financial goals.